Hi There,

I hope you are doing well.

As I am writing this article, I am thinking about to how long it has been since I have been helping people invest in real estate.

I think it has been about 12 years.

Over those years, I have talked to probably thousands of people, and have seen several hundreds of people actually pull the trigger and buy real estate.

I don’t keep the actual number of how many people I have helped, because I am not an egomaniac. 🙂

What I do keep track of though is behavioural patterns of people…

On the whole, people generally act in similar ways.

People who take the leap and buy real estate behave in a somewhat similar way to each other.

Also, people who don’t by real estate generally behave in a similar way as well.

This of course is a tremendous generalization I am making, but hear me out.

Over the past serval years, I have noticed that people who DO NOT buy real estate are making one big mistake with their thinking process

The number one underlying mistake that they are making is:

Listening To Advice From Uneducated Sources…

Okay… so let me break this down and explain to you exactly what I mean.

- People who are interested in buying real estate, but don’t end up buying anything are afraid.

- I should also qualify this statement by saying that people who BUY real estate as well are also somewhat fearful.

The one major difference though between the people who buy real estate and those that do not, is that the ones that DO NOT, are tuned into the wrong radio station.

What I mean by this is that they are listening to the wrong ‘frequency’. They are listening to the wrong ‘sources’, and they are listening to the wrong ‘people’.

So many times, I have heard people tell me….

“I don’t think buying a condo (or home) for investment is a good idea. I am going to get calls in the middle of the night from the tenant saying that they have broken the toilet, and that I need to come and fix it.”

Excuse me, WHAT?

Who the hell is telling people this?! (sorry that I swore…I am getting FIRED up.)

I mean, seriously.

You could make hundreds of thousands of dollars owing just one rental property in The Greater Toronto Area, and you wouldn’t do this because someone may call you regarding a broken toilet?

But wait… it gets better.

The people who are instilling fear into these would-be investors, are not people who own rental properties themselves, they are people with absolutely no experience investing in real estate whatsoever!

- They have never had a tenant before.

- They have never collected a rent cheque before.

- They have limited to no experience in the world of real estate investing.

- They ARE the worst possible person to listen to for advice.

They are generally people who look at the glass as being “half empty.”

And then… they are projecting their concerns, fears, and worries about owning real estate onto those people that are interested in investing, and that are looking for guidance.

They tell them that now is not a good time to buy real estate, and that they should wait, and wait for the ‘bubble to burst’.

“There Is No Bubble”

Okay… If you are from the Greater Toronto Area, there is something that you should realize sooner rather than later.

THERE. IS. NO. BUBBLE.

People talk circles around me when they try to tell me that there is a Bubble in the Greater Toronto Area (GTA) real estate market.

I can list for you major reasons why there is no bubble in the GTA market. If I did here, this article would become the length of a small book and will probably become a New York Times Best Seller!

Seriously, if you think there is a bubble in the GTA real estate market and you believe this wholeheartedly, we could never be friends. 😉

Let’s Re-Cap

Uneducated sources (ie: people), tell aspiring real estate owners (ie: other people interested in buying real estate). That:

- There is a real estate bubble that is going to burst

- They should wait and not buy real estate now

- If they buy a rental property, they are going to have to deal with tenants who are going to call them in the middle of the night regarding a toilet that they just broke. (Apparently this tenant will also want them to come to the rental property in the middle of the night to repair said toilet.)

Here Is The Reality…

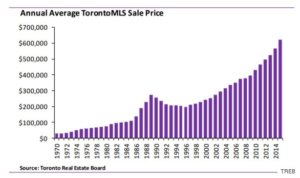

The reality my friends is that the real estate market in the Greater Toronto area is going up at record levels.

The gains that the market is experiencing now, have never been seen before.

There are a number of factors that are causing this, but to simply put it, it is a ‘supply and demand’ issues.

People are coming from all over the world to live in the great rolex yacht master 44mm 116681 78211 herren silberton weises zifferblatt country of Canada, and a large percentage of these people are settling in the GTA.

Now is the time to buy real estate here. Not tomorrow.

The next chapter in this real estate saga will be the Chapter that talks about all of the hundreds of thousands of people that are priced out of the market, and who cannot afford buying a property.

That time is coming, and it is coming sooner than I thought it would.

My closing remarks are:

GET INTO THE REAL ESTATE MARKET NOW.

To your success!

Neil Uttamsingh

ps: I am a Real Estate Broker and a VIP Realtor. I specialize in pre-construction projects and residential resale in the Greater Toronto Area. I have access to over 100 new condo projects all over the GTA. Sign up to receive special builder DISCOUNTS and INCENTIVES that you cannot get from going direct. To your success

pps: If you found this article helpful, you should probably read this one as well… How To Make Money Buying Pre-Construction Condos

ppps: Also, this one.. How To Make Money Buying Real Estate In Toronto