Hi There,

I hope you are doing well.

In today’s blog post, I am going to walk you through how you can make a 26.1% return on your money investing in real estate.

I recently recorded a PODCAST called, 3 Reasons Why Buying A Rental Property Is Better Than Investing In The Stock Market.

In this PODCAST, I talked about 3 ways in which you can make a ‘return’ buying and holding real estate.

These 3 ways were:

To illustrate to you how you can make this type of return on your capital, I am going to take the same example I spoke about in the PODCAST.

Let’s assume that you are a new real estate investor and you are interested in buying your first rental property.

You purchase a property for $450,000.

Let’s assume that you are purchasing a property in the Toronto or Greater Toronto Area real estate market.

As such, you provide a 20% downpayment to purchase the home, which equals ($450,000 * 20% = $90,000)

Therefore your downpayment is $90,000. Don’t forget this number. We will re-visit it later…

The property produces a $500/month net cash flow. (This is on the high side for Toronto, but I am using easy math to help illustrate this example)

You annualize your cash flow by multiplying $500 by 12 months. This gives you ($500 * 12 = $6,000)

Therefore, you have $6,000 annual cash flow from the property.

Since you have provided a $90,000 downpayment, and the purchase price of the home was $450,000, this leaves you with a $360,000 mortgage. ($450,000 – $90,000 = $360,000)

Now let’s assume that you obtain a first mortgage in the amount of $360,000 at a 2.5% interest rate and amortized over 30 years. (What is Mortgage Amortization)

Using a mortgage calculator, we can figure out that your monthly mortgage payment would be $1,422/month.

Now here is where we use some creative math. Let’s assume that 50% of your monthly mortgage payment of $1,422 is principal, and 50% of the payment is interest.

If you use a mortgage calculator for this, you will see that the breakdown is not actually fifty-fifty. However, I am using 50% just to make the math easy.

As such, 50% of $1,422 is $711.

This means that the mortgage amount of $360,000 is paid down by $711 each month.

We want to know how much the mortgage is paid down annually (or at least in the first year), so we take $711 and multiply it by 12 months, which gives us $8,532. This number is also important. We are going to re-visit it shortly.

If the property that you purchased for $450,000 appreciates at 2%, that would mean that the property would go up in value by $9,000 in the first year. We get this number by taking $450,000 and multiplying it by 2%.

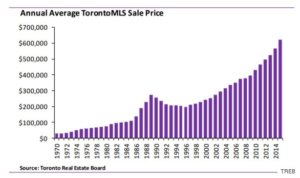

I am using 2% as an extremely conservative figure. The real estate market in Toronto and the Greater Toronto Area has far surpassed this figure over the past several years.

So now we take our return on our capital from year one.

We have $6,000 annual cash flow

We have $8,532 annual mortgage pay down

And we have $9,000 property appreciation in year one.

Now we add up all of these numbers…

$6,000 + $8,352 + $9,000

This equals…

$23,532

We now take this amount (the total amount you have made in year one), and divide it by your initial investment of $90,000. Which gives us…

$23,532 / $90,000 = 26.1%

So as you can see from the math above, you can make a 26.1% return on your investment (in year one) by investing in real estate.

Happy Investing!

-Neil