Real Estate investors tend to be a very strong headed bunch of people that work hard and are goal oriented. Yet at the same time they have a very difficult time admitting when they have screwed up.

Whether an investor owns one property, three properties or three hundred properties there are some early warning signs for when a real estate investor’s business is sinking.

These early warning signs are:

1) A Lack of Enthusiasm

2) Decreased Cash Flow

A Lack of Enthusiasm

If you are around the real estate investing game long enough, you notice that some investors become ‘burnt out’ as time goes on.

Real Estate investors can get ‘burnt out’ at any stage of their real estate investing career. I have personally met investors that have become completely burnt out after investing for 5 years and under. I have also met real estate investors who have become ‘burnt out’ after over 20 years in the real estate investing business.

Once your enthusiasm begins to dwindle, you need to address this issue promptly, otherwise you are in for big trouble.

A lack of enthusiasm means that the landlord becomes less responsive to their real estate investment business. This can prove to be a fatal error. If you take a back seat approach to running your business, a lot of problems can arise.

Due to the fact that an investor takes a back seat and is now less responsive, this could mean that they:

- Become lazy when responding to repairs and maintenance issues. For example, their response time to a tenant request could have been 24 hours at the beginning of their investing career when they were full of energy. They may have now become fed up with investing and as a result, are much slower to respond to tenant request. Maybe now, instead of taking 24 hours to respond…it takes them a week or longer to respond. Trouble really starts to arise when the landlord stops responding on first contact by the tenant. This is a horrible move on the part of the investor when it comes to customer service.

- Not inspecting rental properties. This can cause even the smallest repair item to compound in magnitude over time. For example, a small piece of rust in a bath tub might seem insignificant. If not looked after, the rust will turn into a hole, and the resulting water damage that the house will incur will be significant.

- Failing to thoroughly screen tenants. Every real estate investor, who has been in the investing game long enough has more than likely rented to a tenant that they thought was great before they moved in, however, ended up as a nightmare tenant. If your enthusiasm for our business declines, you will not exercise the same due diligence in screening tenants that you once did. Maybe you have dropped the ball is this department, or maybe you have outsourced the tenant locating process to someone that doesn’t really care who rents your property.

- No longer rewarding tenants. — At the beginning of their real estate investing career, an investor may have provided their tenants with gift baskets at Christmas and the periodic gift card to show their appreciation for being good tenants. Now…well now, the landlord doesn’t give them anything. When the investor no longer has enthusiasm towards their business, they are not doing the little things like this, which make all the difference in the world, especially when it comes to retaining quality tenants.

Decreased Cash Flow

As a real estate investor, you are simply a ship out at sea.

One of your main objectives is to navigate your way through the water. The water represents real estate investing and you are the ship. One of the problems when you are out at sea is that the waters become very choppy.

Without question, choppy waters and storms arise, while you are out at sea. These tough times are directly comparable to the tough times that you will experience as a real estate investor. I relate the choppy water to all of the problems that you would encounter, such as non-paying tenants, dealing with dead-beat tenants, major repairs, and long unexpected vacancies.

One of the key factors that helps to keep your boat afloat during these tough and very scary times is your cash flow. Without cash flow, your boat will sink.

You can think of your cash flow as your life boat.

…you can rely on your cash flow to keep you alive, during the tough times.

Plain and simple, cash flow keeps your real estate investment business alive. As soon as you start to experience a decline in your over all cash flow levels, this matter needs to be closely monitored and dealt with promptly. If you have no cash flow being generated from your real estate business, you will not be able to ‘weather’ the choppy waters or the storms that arise during your real estate investing journey.

Remember…

Cash flow keeps you afloat, during the good times and the bad.

Best Regards,

Neil Uttamsingh

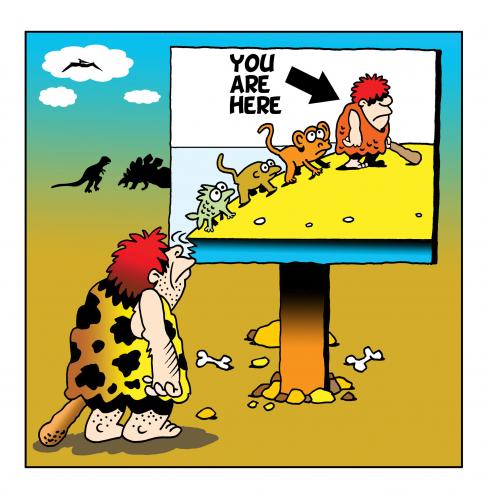

ps: I like pictures. Do you? Subscribe to my blog so you can read more fun picture posts like this one!